It’s time to break up with your bank.

The best place to bank is not a bank.

It’s on the corner of People & Place.

Here are 17 reasons why.

Get a load of all these SESLOC membership¹ and HomeFREE Checking™ account benefits.

1. Check this. It’s free.

Other checking accounts are only free if you choose direct deposit, or if you’re only banking online, or keep a hefty minimum in your account. But HomeFREE Checking is just free — with no monthly fees or minimum balance requirements. Having no monthly maintenance fee could save you $100 or more each year.

Is that something your current bank offers?

2. Two words: Cash Back.

Let’s talk rewards points on debit card purchases.² HomeFREE Checking is the only checking account on the Central Coast that lets you earn points on debit card purchases. That daily latte? You just earned points. That grocery store run? You just earned points. Redeem points at SESLOCRewards.org for cash back, gift cards and super cool swag. Now that’s how you make your money work for you.

Do you get points on debit purchases at your current bank?

3. Get bonus points when you shop local.

We mean literally, as you’ll earn 1.5x in bonus rewards points when you use your HomeFREE Checking debit card at 225+ participating local businesses all across the Central Coast.³ But also figuratively, because shopping locally makes you feel good for supporting our community.

From grocery stores to wineries, retailers and beyond, see where you earn more »

Does your current bank support local businesses?

4. You get complimentary mobile phone insurance.

Your mobile phone gives access to the BEST digital banking app available on the Central Coast, the SESLOC Mobile App. Slick. Fast. and Easy. That’s why we care about making sure your phone is covered. Our HomeFREE Checking account comes with Mobile Phone insurance where you’ll get up to $500 in the event the device is lost, stolen or needs repair.4

Does your current bank care about your smartphone?

5. You get peace of mind from identity theft.

There’s only one you, and we want to keep it that way. With HomeFREE Checking, you get coverage for all types of identity fraud and can protect up to three generations of your family members, a free benefit worth hundreds of dollars each year.5 Privacy advocates can help you resolve identity theft issues. Better to have it and not need it, then to need it and not have it.

Does your current bank care about the health of your identity?

6. You get access to direct deposit funds up to one day early. 6

With Direct Deposit, checks can’t get lost, stolen or delayed, so funds are readily available on the date your check is issued. Tax refunds, paychecks, Social Security or any recurring checks are automatically deposited, even if you’re sick or on vacation. That means no delays, no standing in lines, and no worries.

Does your current bank deposit funds up to one day early?

7. Checks deposited on the SESLOC Mobile App are deposited in real-time.

That’s right. Funds are available in just a few minutes — even on holidays and weekends!7 Why drive across town to a branch or ATM? You can use the SESLOC Mobile App to deposit checks right where you are, and start spending.

Is that something your current bank can do?

8. You get more access to ATMs than most banks.

Look. We know ATM fees can be ridiculous. That’s why you might choose a big bank—to make sure there’s an ATM wherever you go. But did you know SESLOC is part of the CO-OP network? It’s a shared network among lots of credit unions.

That means access to 55 fee-free ATMs on the Central Coast and nearly 30,000 nationwide. We haven’t even been to 5,000 places, let alone 30,000. Trust us, you’re covered. (And if you don’t believe us, try texting any zip code to 91989 to find one).

We know your current bank has less ATMs than our CO-OP network.

9. You get instant access to your card.

Forget waiting 7-10 business days for a debit card to arrive in the mail. We can instant-issue HomeFREE Checking debit card in any branch. You can deposit funds and start earning reward points on purchases right away. Of course, if you are opening your account now online, or prefer to have the debit card mailed to you so you skip a branch visit, we can do that, too..

Is that something your current bank does?

10. Cal Poly fan? We got you.

HomeFREE Checking is a must have for Mustangs — from students, to alumni, to parents, and fans. Show your pride with our Cal Poly Proud debit card design. No matter which design you choose, you’ll earn bonus rewards points on purchases at the Mustang Shop on and off campus, Mustang Lanes, and the Cal Poly Ticket Office. Ride High!

Does your bank Ride High?

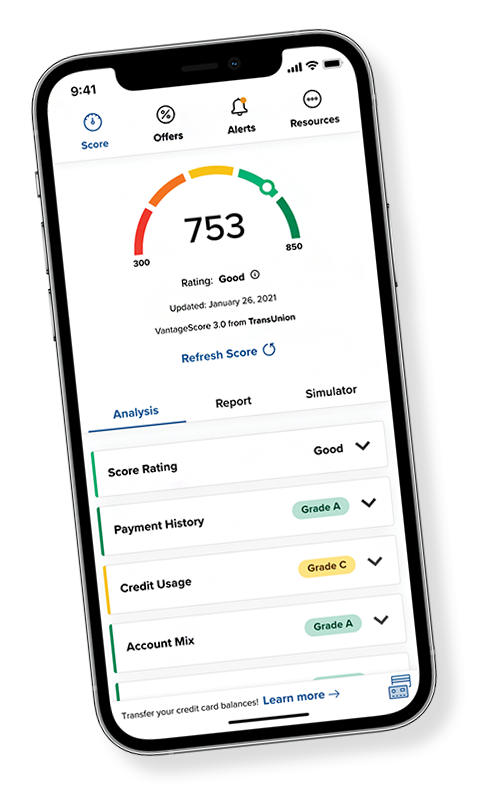

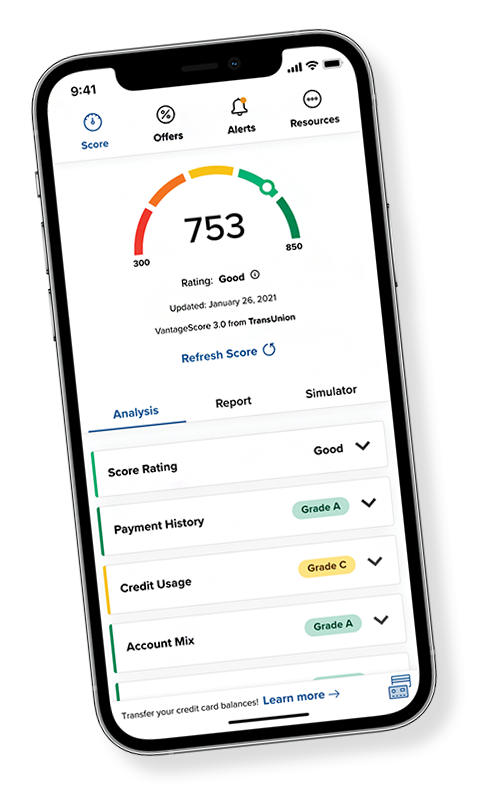

11. See your credit score every time you log in.

SESLOC Online Banking is packed with tools to help you set budgets and track your spending and savings goals. One of our most popular tools is the credit score widget (powered by Savvy Money).8 With easy-to-read charts and graphs and the ability to link all of your financial accounts, it’s a one-stop-shop. No third-party app needed, which means your information stays safe.

Does your current bank offer ALL of these tools?

12. You get help making money moves.

Learning should never stop. That’s why we offer online videos and articles, financial calculators, and live webinars to help you get the most of your hard-earned money. Can’t make it to a live webinar? No worries, sign up and we’ll send a recording so you can watch on your own time.

Does your current bank help you achieve your financial goals and dreams?

13. You get a chance to “Level Up.”

At SESLOC, when you do more, you get more. We’ve got an exclusive Level Up Member Benefits program that rewards you with select fee waivers, waived check orders and discounts on eligible personal and auto loans.9 Benefits are based on your credit union activity, so you might as well join today, so you can start earning today!

Does your current bank reward you for ALL that you do?

14. You get unbeatable member service. Robot free!

Everyone can claim their customer or member service is great. But unlike large banks with distant service, SESLOC staff is located right here on the Central Coast. When you call our Contact Center—which is an 805 area code—you’re speaking to a real live human. When you Live Chat with us, we are bot-free.

Does your current bank have an 805 area code?

15. Your money stays local and supports your community.

When you move your accounts to SESLOC, your deposits help finance a car, a house or an emergency medical bill for your friends and neighbors who are also members at SESLOC. Because being there for our People & Place is what it’s all about. We bet your big bank doesn’t put its money where your community is.

Does your current bank care about your friends and neighbors?

16. You get to say you’re an owner of the credit union.

At SESLOC, membership means ownership. Just establish membership with a $5 fee and $5 deposit in your savings account, and you’re in. Some of us have been members for 50+ years.

Are you an owner of the bank, or just a customer?

17. The headquarters is on Broad Street, not Wall Street.

Broad Street, San Luis Obispo that is. With no outside shareholders, investors or employee resources, your money stays local. With a Board of Directors voted on by you, the members, and local decision-making, we understand the unique needs of our community. You can count us for low rates, fees and uncomplicated pricing. Because we live and work here, so we’re invested in making the Central Coast the best place to live.

Does your current bank’s shareholders have your best interest in mind?

Whew!

That was 17 reasons to break up with your bank.

But there are so many more, we just can’t fit them all on this page.

You’ll find us on the corner of People & Place.

Where ease meets access. Affordable meets banking. And dreams meet living.

Join us to experience the Credit Union Difference.

What is a credit union? May I join?

Credit union members share a common bond, such as where they work or live. We are a cooperative financial institution, formed to give back to our members, not stockholders. Profits are returned to members in the form of lower loan rates, higher savings rates, and lower cost services. Our members are local, so money stays local, and SESLOC stays community focused.

You are eligible for membership if you live, work or attend school in San Luis Obispo, Santa Barbara, Ventura, Monterey, Santa Cruz, Fresno, Tulare, Kern and Kings counties. Or, if you have a family member who is already a member at SESLOC, you could join too. Simple as that.

To get started, you’ll pay a one-time membership of just $5, and deposit $5 into a Primary Share Savings account. Then, you’re eligible for Everyday Member Benefits.

Let’s Go!

Join SESLOC and open your free checking account online in just minutes.

ITIN and Matrícula Consular ID cards accepted

Or see our helpful FAQs »

On the Scene

We love being out and about in our community. If you see us at an event, be sure to stop by and say hi!

Still thinking about it?

If you made it this far and are still in the fence, then believe us when we say…