Mechanical Breakdown Insurance

Essential Protection at a Low Cost

A breakdown can be troubling enough without the added worry of expensive repairs. That’s why we’re pleased to offer Mechanical Breakdown Insurance¹ to SESLOC members.

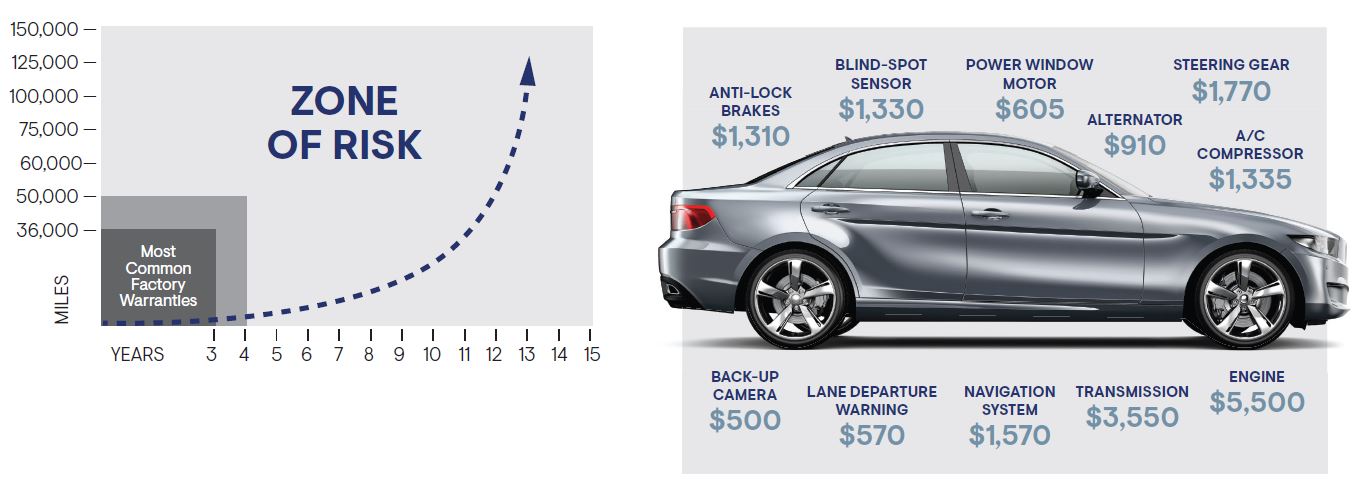

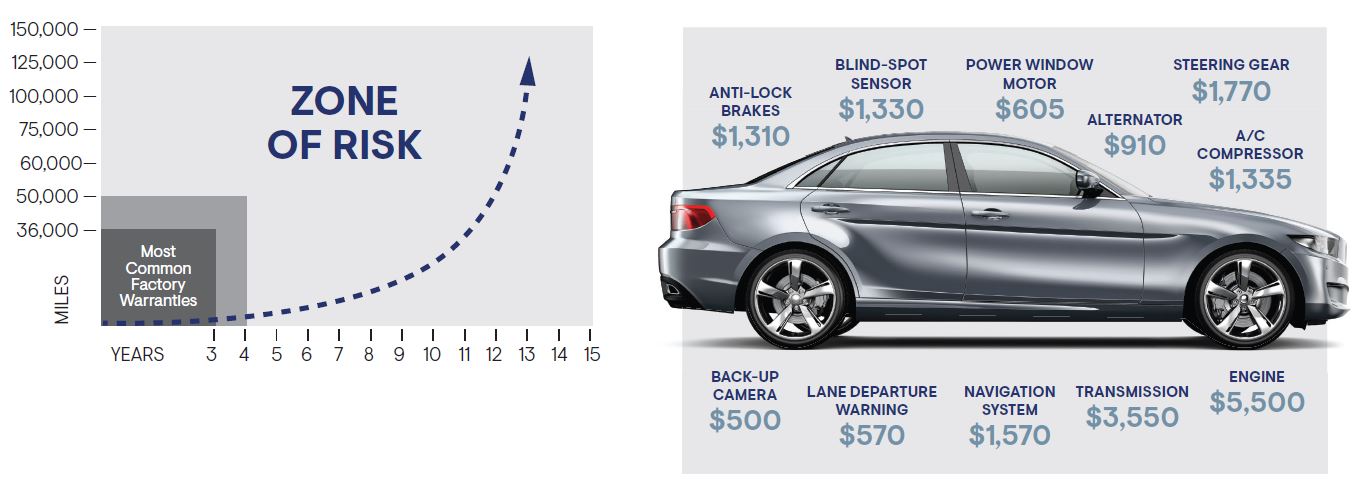

As your vehicle gets older, the risk and cost of repairs increases.

And the average cost of those repairs can be expensive.²

Mechanical Breakdown Insurance may help limit unexpected covered repair costs as your vehicle ages, potentially saving you thousands of dollars in repairs.

What’s more, it works at any authorized repair facility in the U.S. or Canada.

Additional Coverage Benefits

- Rental reimbursement: up to $35 per day (5-day maximum, 10-day maximum for parts delay); available on the first day of a covered repair.

- 24-hour emergency roadside assistance: up to $100 per occurrence; includes towing, battery jumpstart, fluid delivery, flat tire assistance and lock-out service.

- Travel expense reimbursement: up to $200 per day (5-day maximum) for lodging, food and transportation expenses when a covered breakdown occurs 100 miles or more from home and your vehicle is held overnight at a repair facility; not available to residents of NY.

- Good at any authorized repair facility in the continental United States of America, Alaska, Hawaii and Canada

- No out of pocket expense (except for any deductible): the administrator pays the repair facility directly for the covered repair.

- Transferable: if you sell your vehicle privately, the coverage can be transferred (for an administrative fee), adding resale value and appeal.

- Cancelable: receive a full refund for an unused agreement within the first 60 days, or a prorated refund thereafter less an administrative fee.³

(805) 543-1816

or visit any branch

Drive with confidence, knowing we’ve got your back.

Whether you are purchasing, refinancing or simply want extra protection for your current vehicle, we’re here to help.

Talk to us about a plan that’s right for you and fits your budget.

1. Mechanical Breakdown Insurance in California is provided and administered by Virginia Surety Company, Inc. This coverage is made available to you by CUNA Mutual Insurance Agency, Inc. Your purchase of Mechanical Breakdown Insurance is optional and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions, and exclusions may apply. Replacement parts may be new, used, non-OEM or remanufactured. Be sure to read the Vehicle Service Contract or the Insurance Policy, which will explain the exact terms, conditions, and exclusions of this voluntary product.

2. Actual costs may vary by vehicle year, make and model. Prices are based on actual claim experience of Consumer Program Administrators, Inc. and its affiliated companies’ customers as of January 2021. Your experience may be different.

3. Cancellation provision and administrative fees vary by state.

Auto Buying Tips

From the News+ Blog

Buying Your First Car? This is What You Need to Know:

Shopping for your first car is exciting, but it can also feel intimidating. It’s a major commitment, but one that will give you the freedom to go where you want, when you want. Before you head to the car lot, set yourself up for success by following these steps:

What to Know About Private Party Auto Loans

If you’re planning to buy a car directly from a seller, you might be interested to know that SESLOC can finance your purchase — just like if you were buying from a dealership. This arrangement is called a private party sale, and this is what you can expect:

6 Money Saving Tips for Car Owners

Car ownership is an investment that gives you the freedom and flexibility to travel on your terms. But as car owners know, it can be expensive. Besides budgeting for the payments, you must plan for the costs associated with registration, insurance, fuel, and routine and emergency maintenance.